About Medicare Graham

Table of ContentsMedicare Graham Things To Know Before You Get ThisThe Definitive Guide to Medicare GrahamMedicare Graham Things To Know Before You Get This8 Easy Facts About Medicare Graham DescribedMedicare Graham - TruthsThe Definitive Guide to Medicare GrahamMedicare Graham Things To Know Before You Buy

You can: Call the plan you desire to leave and ask for a disenrollment type; or Call 1-800-MEDICARE (1-800-633-4227) to demand that your disenrollment be refined over the phone; or Call the Social Safety and security Management or see your Social Safety and security Office to file your disenrollment request. The contact number for the Social Protection office in your area can be discovered in the Important Phone Numbers section of this site.There are some Medicare Wellness Strategies that cover prescription medications. You can also examine into getting a Medigap or supplementary insurance policy for prescription medicine protection.

8 Easy Facts About Medicare Graham Described

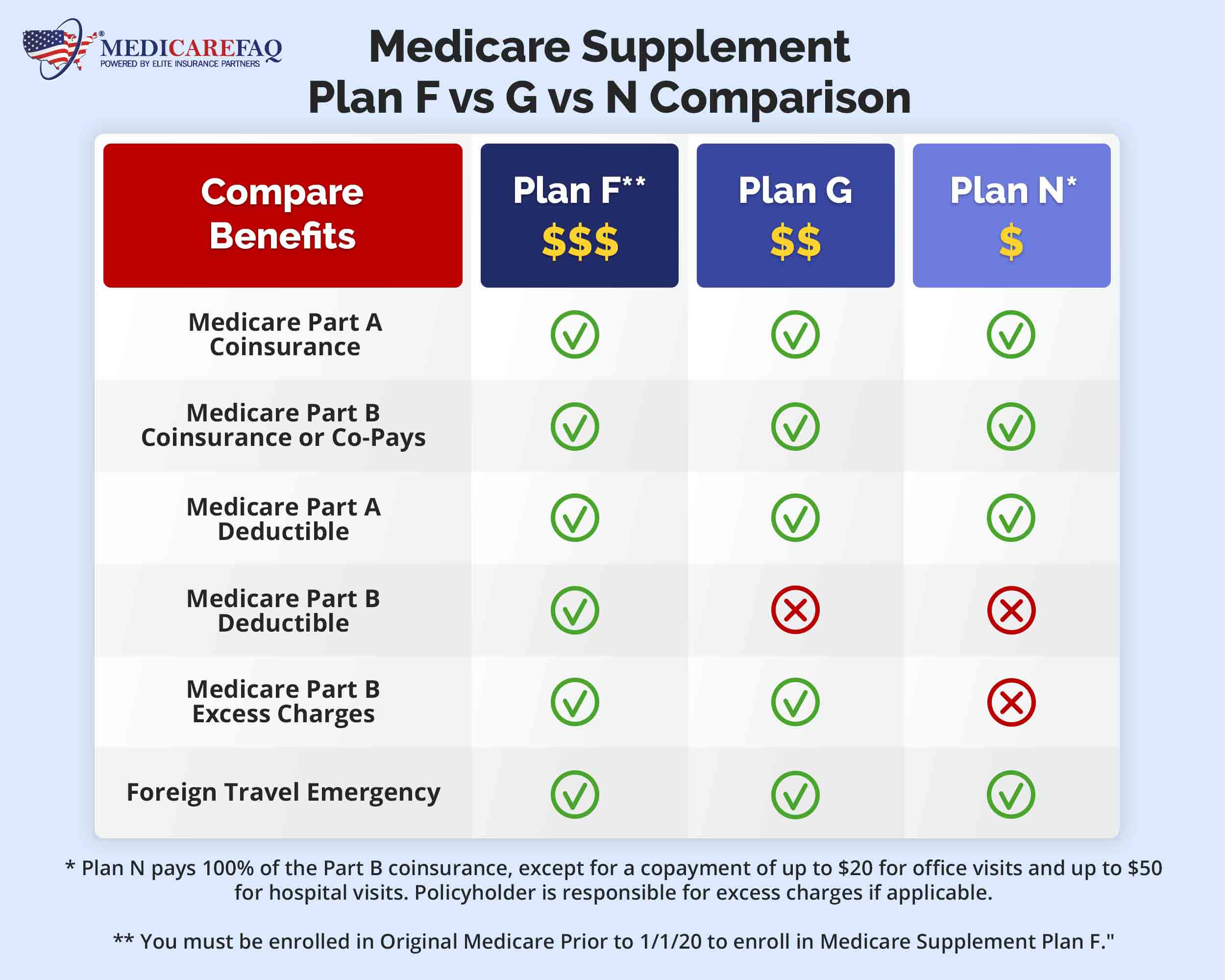

Medigap strategies are personal health insurance plans that cover a few of the costs the Initial Medicare Plan does not cover. Some Medigap plans will cover solutions not covered by Medicare such as prescription medications. Medigap has 10 common strategies called Plan "A" via Plan "J". Each strategy has a different collection of benefits.

Your State Insurance coverage Division can respond to questions about the Medigap plans sold in your location. Examine the Important Phone Figures section of this web site for the telephone number of your State Insurance Division. If you have actually worked at the very least 10 years in Medicare covered employment you will get premium totally free Medicare Component A (Health Center Insurance Coverage).

Medicare Graham - Truths

Check the Important Phone Numbers section of this web site for the contact number of the Social Safety And Security Office in your location. Medicare Component B assists pay for medical professionals' solutions, outpatient health center treatment, blood, medical equipment and some home health solutions. It likewise spends for other medical solutions such as laboratory tests and physical and job-related therapy.

Medicare Graham for Beginners

Medicare does not cover insulin and syringes. A deductible is the quantity you need to pay each year before Medicare starts paying its part of your medical bill. Medicare Near Me.

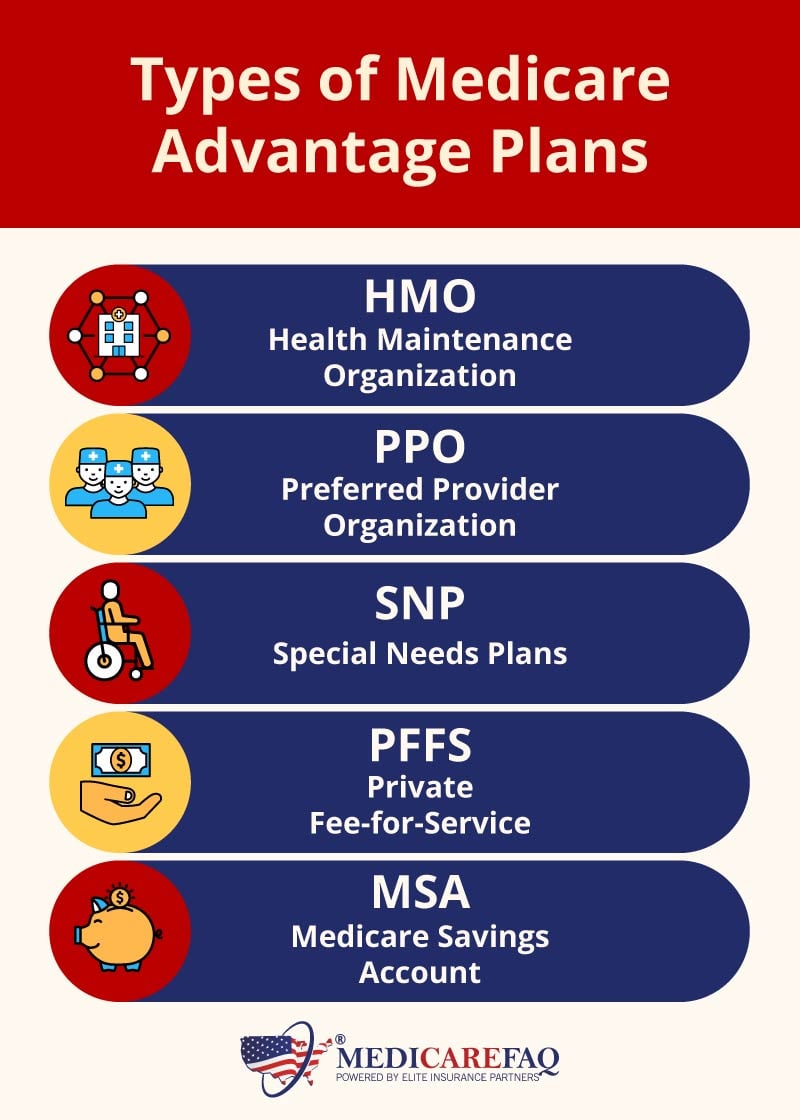

Your deductible is taken out of your claims when Medicare obtains them. Medicare took care of care plans are another way for you to receive Medicare benefits.

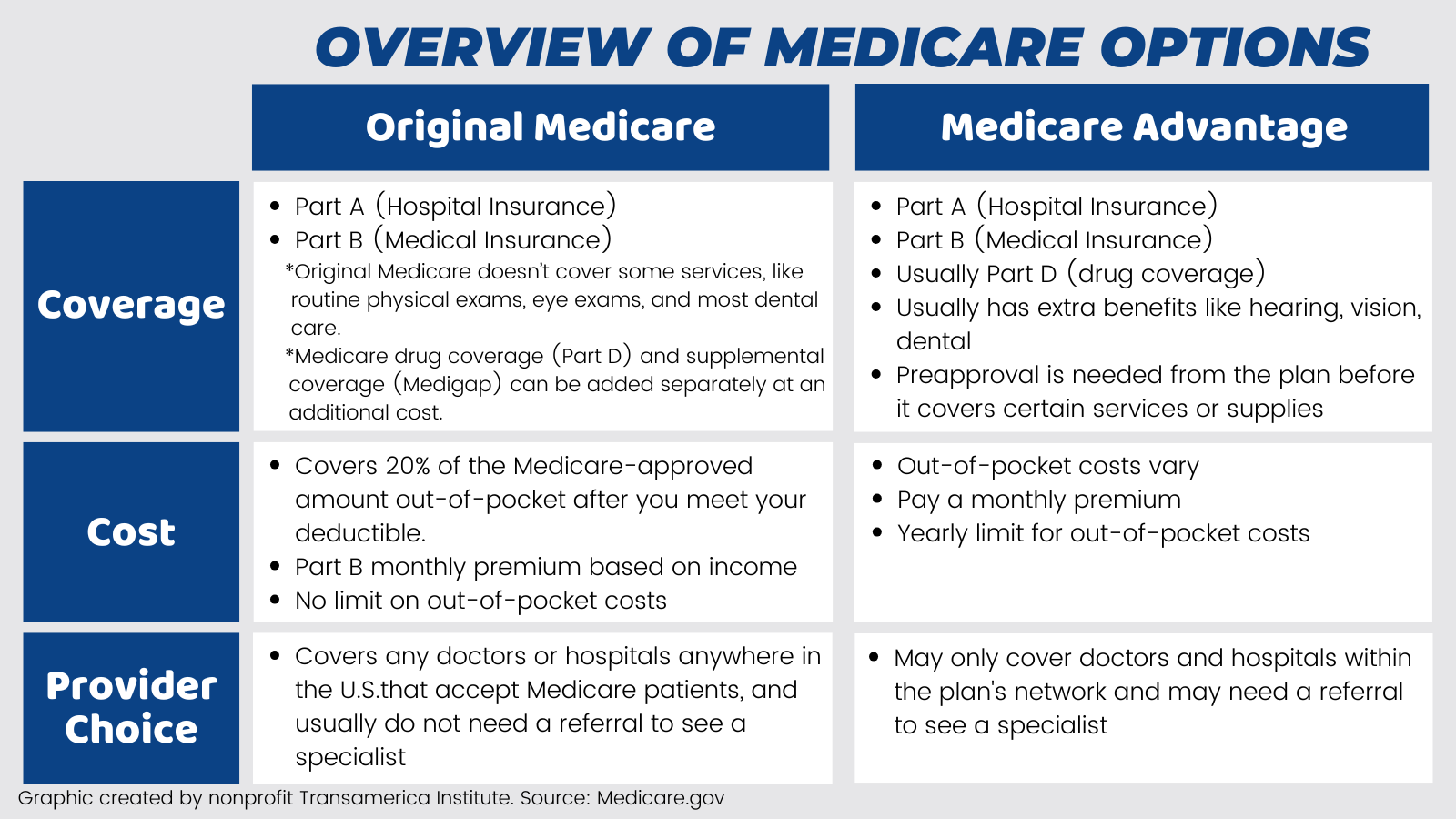

There are 4 components of Medicare: Part A, Part B, Part C, and Component D. As a whole, the 4 Medicare components cover different services, so it's important that you comprehend the options so you can pick your Medicare insurance coverage meticulously. Perhaps you're getting near the age of 65 or simply wish to recognize exactly how Medicare jobs so you can help a member of the family or friend.

Whatever your scenario, you end up being eligible for Medicare when you get to 65. If you already receive Social Security, you'll be registered in Medicare automatically the month you turn 65. For the majority of people, there is no regular monthly cost for Component A if you or your spouse paid Medicare tax obligations for at least 10 years.

At that point, you pay $0 for the initial 60 days of coverage. Co-payments get stays past 60 days and you pay for the entirety of your medical facility remain after 150 days. Medicare Part A covers hospice treatment at an inpatient center, it needs to be arranged via a Medicare-approved hospice company.

Medicare Graham for Dummies

Kathryn B. Hauer, an economic advisor at Wilson David Investment Advisors and the author of Financial Suggestions for Blue Collar America, alerts that devastating health problems such as cancer can ravage your finances in retirement and prompts Medicare receivers to think about auxiliary protection. She notes that Medicare users without Medigap protection invest 25% to 64% of their earnings on clinical expenses.

Medicare Graham Fundamentals Explained

Comments on “How Medicare Graham can Save You Time, Stress, and Money.”